Your 2024 Benefits

Medical Benefits

Eligibility

Eligibility is the first of the month coinciding with or following the date of hire for employees scheduled to work 30 hours or more per week.

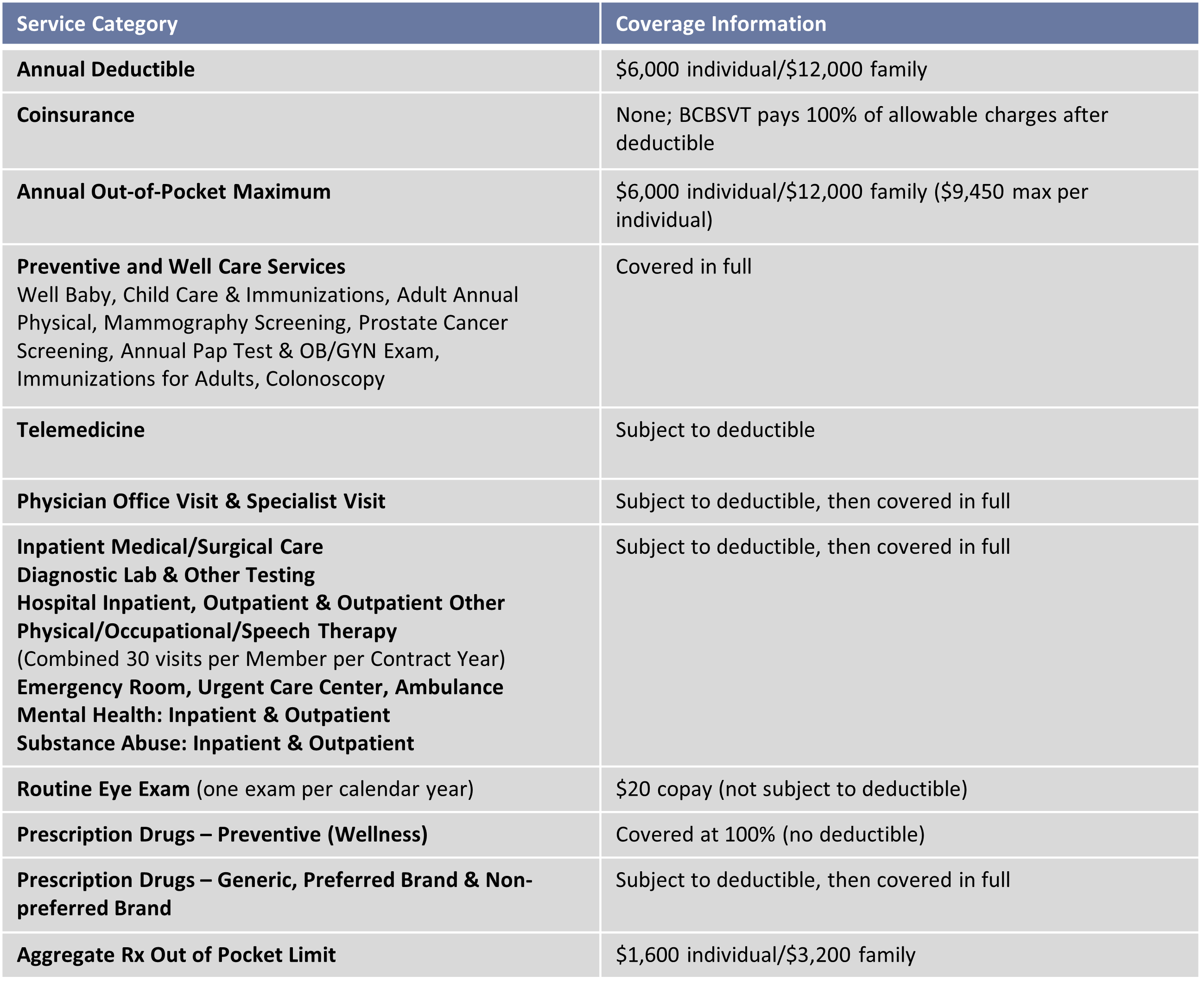

Summary of Benefits and Coverages

The Town of Brattleboro is pleased to offer their employees health insurance through BCBSVT in 2024.

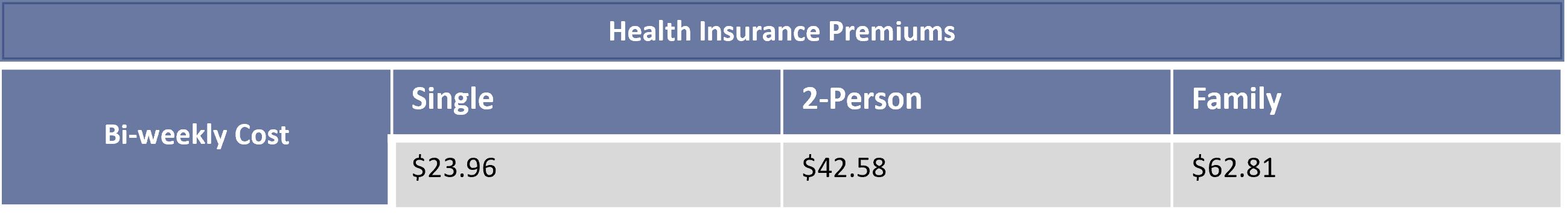

Employee Cost

Maternal Health Program – Better Beginnings

Better Beginnings is BCBSVT’s free maternal health program. When you enroll, you’ll be partnered with a nurse who will help you coordinate your care and connect you with resources both during and after your pregnancy, such as lactation consultants.

You’ll also receive:

- A $125 stipend for classes on relevant topics such as childbirth, breastfeeding, and parenting

- A free breast pump

And these additional benefits if you enroll before you are 34 weeks pregnant:

- Up to $150 reimbursement for fitness classes you take while pregnant or up to 3 months postpartum

- Up to $150 reimbursement when you purchase a car seat

- Up to $225 reimbursement for a visiting helper’s services after you give birth

You can enroll in several ways:

- Download the mobile app, Wellframe (Note: only enter the letter “v” on your member ID card, followed by numbers only, and the access code ‘vtbeginonline’ when prompted)

- Log into your BCBSVT account at https://www.bluecrossvt.org/member-logins and go to “My Forms” and complete the Better Beginnings enrollment form

Carrier Contact Information

BlueCross BlueShield of VT: Medical Insurance

Customer Service: 800-247-2583

Website: www.bcbsvt.com

Please click here for the BCBSVT Provider Directory

Please click here for the BCBSVT Drug Formulary.

*To see the prescription drugs covered under your plan you will need you ID card to help determine which formulary will apply to you. The formulary lists that apply to the Town of Brattleboro’s health plan are under the National Performance Formulary section (NPF).

Documents

Transparency in Coverage

By clicking on the button below, you will be led to the machine readable files that are made available in response to the federal Transparency in Coverage Rule and includes negotiated service rates and out-of-network allowed amounts between health plans and healthcare providers. The machine-readable files are formatted to allow researchers, regulators, and application developers to more easily access and analyze data.

Additional Information

Telehealth Benefits

Employees enrolled in the BlueCross BlueShield of VT medical plan have access to telehealth services offered through Amwell. via phone or video conference, you can consult with a board certified physician to obtain convenient care for minor conditions/symptoms. You are encouraged to register now, so you can avoid this process in the future when circumstances cause to to obtain a consult. Any payments for these services are automatically applied to the out-of-pocket maximum under your plan.

Amwell also offers psychiatry and virtual counseling services. Their licensed therapists can help with a variety of issues, including:

- Anxiety

- Depression

- Stress management

- LGBTQ+ counseling

- Bereavement/Grief

- OCD

- PTSD/Trauma

- Couples therapy

- Panic attacks

- Insomnia

- Life transitions

Help Center Contact Information

Your BCBSVT medical plan also covers the platforms Valera Health and Sondermind for mental health counseling and psychiatry.

Health Savings Accounts (HSA)

Health Savings Accounts

Health Savings Accounts (HSA)

A Health Savings Account (HSA) is a tax-advantaged savings account owned by an individual that can be used to pay for qualified medical expenses for the account owner and their dependents. An HSA, which must be paired with an HSA-qualified health plan (like the Town sponsored HDHP medical plan), allows employees and employers to make pre-tax contributions to a federally-insured account. All of the money in an HSA (including employer contributions) is owned by the employee even if they leave their job, lose their coverage or retire. The money in an HSA never expires and all funds roll over each year.

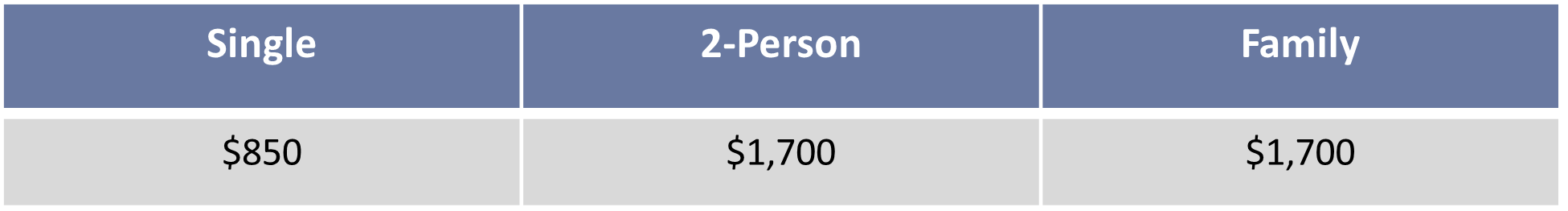

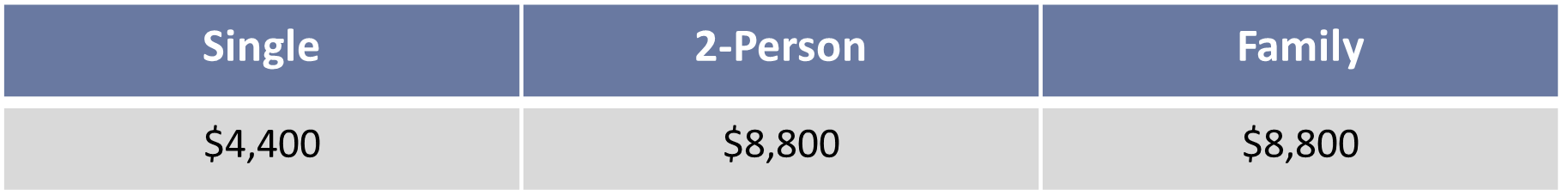

The Town of Brattleboro will contribute the following to an employee’s HSA in 2024:

In addition, you can contribute your own money to cover any remaining out of pocket expenses. The total maximum contributions (a combination of the Town’s contributions and employee deposits) allowed in 2024 by the IRS are:

$4,150 for single coverage

$8,300 for two-person or family coverage

A catch up contribution of $1,000 can be made if over the age of 55.

Distributions from the HSA are tax-exempt if used for qualified expenses. Distributions made for other than qualified medical expenses are subject to income tax and a 20% penalty. Anyone covered by another health insurance plan (Medicare, spouse’s policy) is not eligible for an HSA.

HSA Eligibility

To be eligible for an HSA, an employee must:

- Be enrolled in a qualified HDHP

- Not be claimed as a dependent on another’s tax return

- Not be enrolled in Medicare

- Not be insured under any other medical plan that is not an HDHP

HSA Forms

If you are enrolling in an HSA for the first time with the Town of Brattleboro, you will need to complete the HSA form found below and return to HR before any HSA contributions can be made to you and your HSA account.

Additional Information

Health Reimbursement Accounts, Dependent Care Accounts & Flexible Spending Accounts

Health Reimbursement Account (HRA)

A Health Reimbursement Account (HRA) is a funding arrangement provided to help offset expenses associated with an IRS qualified high deductible health plan (HDHP). The HDHP offered by the Town of Brattleboro is a qualified plan. The amounts shown below will be used towards your out of pocket medical and prescription expenses and are 100% employer funded.

The HRA is administered by Healthy Dollars and just like your HSA, an HRA will automatically be established for you if you enroll in the Town sponsored HDHP medical plan.

Dependent Care Account (DCA)

The Dependent Care Account allows employees to use pre-tax dollars toward qualified dependent care such as caring for children under age 13 or elder care. In 2024, the annual maximum amount you may contribute to the Dependent Care Account is $5,000 (or $2,500 if married and filing separately) per calendar year.

Flexible Spending Account (FSA)

The Flexible Spending Account (FSA) allows employees who choose to opt out of the Town’s medical plan the opportunity to set aside pre-tax dollars for unreimbursed medical, dental, vision or other health related expenses. In 2024 the maximum amount an employee can contribute to an FSA is $3,200. This plan includes a rollover provision that allows employees enrolled in an FSA to rollover up to $640 of unused funds into the next plan year.

To view a comprehensive list of FSA eligible expenses, please click on the link below.

Healthy Dollars Website Instructions

Employees who participate in an FSA and/or DCA will be issued a debit card to pay for eligible expenses. Employees will be responsible for managing their FSA accounts on the Healthy Dollars website.

To Register:

- Login at www.healthydollarsinc.com

- Click on “Employee Login”

- Click on “Register”

- Select a Username (between 5-16 characters); Select a Password (follow instructions for requirements)

- Enter your first and last name, email address, employee ID (social security number with no dashes)

- Registration ID: use the drop down menu to select the Card Number, enter 16 digit card number in the space. Please note: if you do not yet have your Healthy Dollars Debit Card, select “Employer ID” from the drop down menu and enter AAITBRATTLEB into the field.

- Make sure to accept terms of use

- Click on the ? Mark bubbles to get additional help

Once your registration is complete, you can:

- View FSA/DCA plan activity

- Receive claim/reimbursement notices

- Submit claims if needed

Carrier Contact Information

Additional Information

FSA/HSA Store

The Town of Brattleboro has entered into a partnership with Health-E Commerce, also known as the FSA/HSA Store. This gives you access to hundreds of products that have been pre-vetted & approved for use with your Flexible Spending or Health Savings Accounts.

Did you know you could use your FSA/HSA to save money on everyday health essentials like baby health items, health trackers, pain relief products and more?

Here are just a few benefits of using the FSA/HSA Store:

- No Receipts Needed

- 2,500+ FSA Eligible Products

- 100% Eligibility Guaranteed

- Skip the claims process when you use your FSA/HSA card

This partnership also allows access to their Caring Mill products. Caring Mill is a line of premium healthcare products that support a healthy lifestyle and on average is priced 30% less than branded equivalent products.

With every Caring Mill purchase, a donation is made to Children’s Health Fund, providing necessary treatments to thousands of children in need, throughout the United States.

Curious what your FSA/HSA dollars can cover? Simply enter the product you are looking for in the eligibility list below.

To access the FSA Store please visit: https://fsastore.com

To access the HSA Store please visit: https://hsastore.com

Additional Information

Health Advocate

What is Health Advocate?

Health Advocate is a service provided to employees participating in the health insurance plan which allows assistance to employees, their spouses, dependents, parents and in-laws.

Health Advocate can assist employees with:

- Finding a doctor/provider

- Getting an estimate on the cost of a procedure

- Expediting appointments

- Negotiating payment plans

Carrier Contact Information

Health Advocate: Health Assistance

Customer Service: 866-695-8622

Website: www.healthadvocate.com/members

Forms and Plan Documents

Dental Benefits

Eligiblity

Eligibility is the first of the month coinciding with or following date of hire for employees scheduled to work 20 or more hours per week.

Summary of Benefits and Coverages

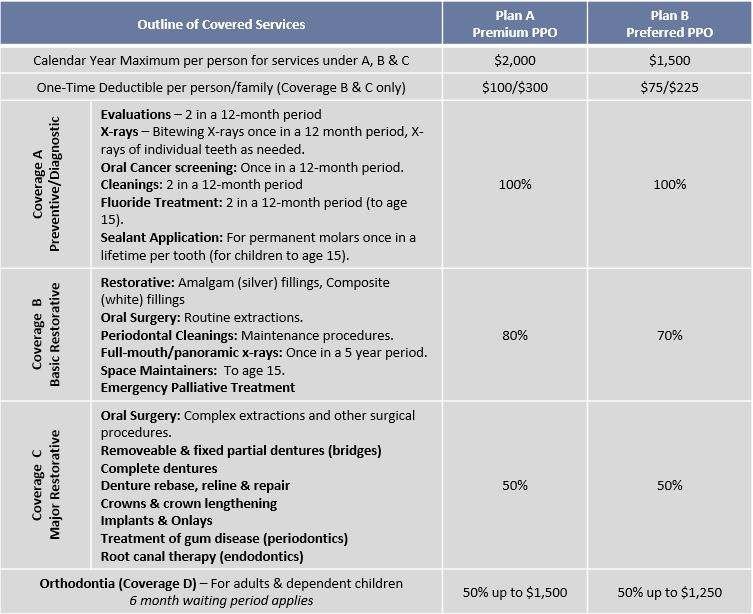

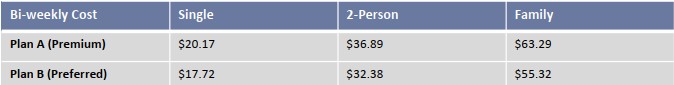

The Town of Brattleboro will offer, on an employee-paid basis, a comprehensive dental plan through Delta Dental. Employees scheduled to work 20 or more hours per week may elect group dental insurance.

Below is a summary of services:

Contributions & Rates

Carrier Contact Information

Delta Dental: Dental Insurance

Customer Service: 800-329-2011

Website: www.nedelta.com

Please click here for the Northeast Delta Dental Provider Directory

Forms and Plan Documents

Vision & Hearing Benefits from Delta Dental

Helpful Videos from Delta Dental

Additional Information

Vision Benefits

Eligibility

Eligibility is the first of the month coinciding with or following date of hire for employees scheduled to work 20 hours or more per week.

Summary of Benefits and Coverages

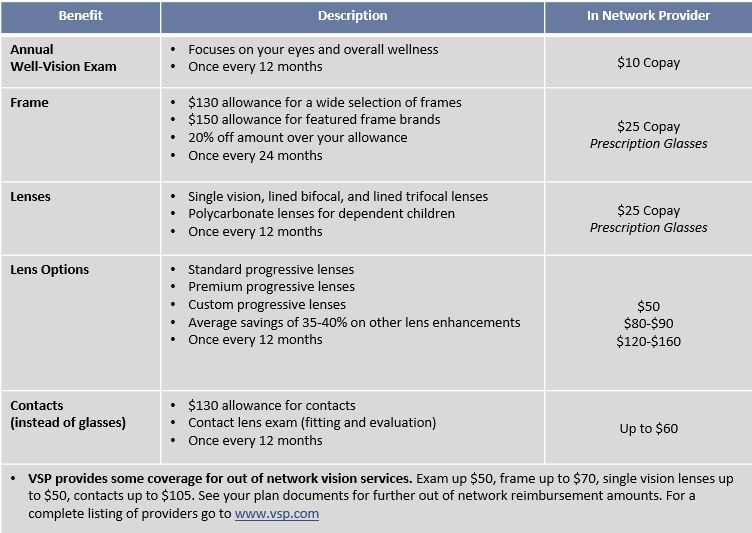

The Town of Brattleboro will continue to make available, on an employee-paid basis, a comprehensive Vision Plan through VSP. Employees scheduled to work 20 or more hours per week may elect group vision insurance.

Remember to verify your provider’s acceptance of VSP and note there is an out of network allowance to be reimbursed.

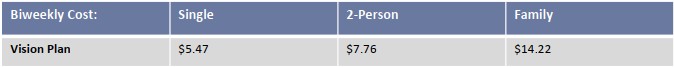

Contributions & Rates

Carrier Contact Information

VSP: Vision Insurance

Customer Service: 800-877-7195

Website: www.vsp.com

Click here for the VSP Provider Directory

Additional Information

VSP provides some reimbursement coverage for out of network vision services. For a complete listing of network providers go to www.vsp.com

Extra savings are also available on featured frame brands, sunglasses, retinal screening and laser vision correction. Please see the Vision Discount Program Form under Forms and Plan Documents for more information.

Forms and Plan Documents

Basic Life and AD&D Insurance

Eligibility

Eligibility is the first of the month coinciding with or next following date of hire for employees scheduled to work 30 or more hours per week.

Summary of Benefits and Coverages

The Town of Brattleboro provides benefit-eligible employees with the core benefits of life insurance and accidental death & dismemberment insurance. Please click on the button of the class you belong to below for further information on your Life and AD&D benefits:

Carrier Contact Information

NY Life: Life and AD&D Insurance

Customer Service: 888-842-4462

Website: www.nylife.com

Contributions

Basic Life & AD&D is 100% paid for by the Town of Brattleboro.

Forms & Plan Documents

Cigna Value Added Programs

Voluntary Life and AD&D Insurance

Eligibility

Eligibility is the first of the month coinciding with or next following date of hire for employees scheduled to work 30 or more hours per week.

Summary of Benefits and Coverages

Eligible employees may purchase coverage in increments of $10,000 to a maximum of $300,000. Employees are guaranteed an issue amount of $150,000 and will be required to complete an Evidence of Insurability (EOI) form to receive the additional coverage up to the $300,000 maximum.

Employees may purchase coverage on their spouse in increments of $5,000 to the lesser of either a $150,000 maximum or 50% of Employee’s Voluntary Life Insurance amount. This coverage will end for your spouse once they reach age 70.

Employees may also purchase coverage on their dependent child(ren) up to the amount of $10,000. From birth to age 6 months the coverage maximum is $500. And from 6 months to 26 years, you may purchase in increments of $1,000 to the $10,000 maximum.

Employees may also elect Supplemental Accidental Death & Dismemberment (AD&D) coverage for themselves, their spouse and dependent children under age 26 . The AD&D benefit is equal to the voluntary life insurance benefit amount elected.

Please note: this benefit reduces to 65% at age 65 and to 50% at age 70.

Carrier Contact Information

NY Life: Life and AD&D Insurance

Customer Service: 888-842-4462

Website: www.nylife.com

Contributions

Voluntary Life & AD&D is 100% paid for by the employee if they elect this benefit.

Forms & Plan Documents

Long-Term Disability Insurance

Eligibility

Eligibility is the first of the month coinciding with or next following date of hire for employees scheduled to work 30 or more hours per week.

Summary of Benefits and Coverages

Long-Term Disability Insurance:

- 100% funded by the employee (benefit is not taxable).

- Benefit is 66 2/3% of basic monthly earnings up to a $5,000 maximum.

- Payment of benefits begin after 180 days from the start of a qualified disability.

Contributions

Long Term Disability Insurance is voluntary and 100% funded by the employee.

Carrier Contact Information

NY Life: Life and AD&D Insurance

Customer Service: 888-842-4462

Website: www.nylife.com

Plan Forms and Documents

VMERS (Vermont Municipal Employees’ Retirement System)

Eligibility

Retirement coverage extends to the following classification of employees: All municipal employees who work on a regular basis for not less than 24 hours per week for not less than 1,040 hours in a year.

Summary of Retirement Plans

The Town recognizes the importance of saving for retirement and offers several plans to support our employee’s efforts in this regard.

Vermont Municipal Employees’ Retirement System (VMERS) is a defined benefit public pension plan provided by the State of Vermont for participating municipalities’ employees. It was created in 1975 and is governed by Vermont Statute Title 24, Chapter 125. In a defined benefit system, there is a promise to provide members with a monthly retirement allowance, providing they serve a minimum number of years of service in the system. The benefit is generally defined through a statutory formula that takes into account the member’s age, average final compensation and years of service. Benefits are guaranteed to be paid for the remainder of the member’s life after retirement and may be passed along to another individual after the member’s death under certain options that maybe elected at retirement.

Retirement coverage extends to the following classification of employees: All municipal employees who work on a regular basis for not less than 24 hours per week and for not less than 1040 hours in a year.

Employees must join the system as a condition of employment and begin contributions immediately upon date of hire. You will be vested in VMERS upon the attainment of five (5) years of creditable service.

- Sworn Police Officers and Professional Firefighters are enrolled in Group D – members make pre-tax contributions equal to 12.850% of gross pay.

- All other employees hired to regularly work at least 24 hours a week are enrolled in Group B – members make pre-tax contributions currently equal to 6.375% of gross pay.

The Defined Benefit Plans of the Vermont Municipal Employees’ Retirement System are actuarial reserved, joint-contributory programs. In these plans, the members and their employers make contributions to the fund, qualified as a tax-exempt organization under Sections 401(a) of the Internal Revenue Code (IRC). These funds are invested and interest earnings on the investments are placed in a reserve to pay benefits to the retired members and beneficiaries of deceased members. The law requires the retirement fund to remain in actuarial balance. This guarantees to the members the availability of funds to pay their benefits when they retire. More information about the VMERS Plan is available online at www.vermonttreasurer.gov/vmers

Contact Information

Vermont Municipal Employees’ Retirement System (VMERS)

Website: www.vermonttreasurer.gov/vmers

Plan Forms and Documents

457(b) Retirement Plan

Eligibility

Retirement coverage extends to the following classification of employees: All municipal employees who work on a regular basis for not less than 24 hours per week for not less than 1,040 hours in a year.

Summary of Retirement Plans

457(b) Plan

The Town of Brattleboro also sponsors a 457(b) deferred compensation plan which is administered by Lincoln Financial Group. Participation in the plan is voluntary. You are immediately eligible to defer a portion of your salary into the 457(b) plan with pre-tax dollars or Roth after-tax dollars up to the IRS limit ($23,000 in 2024). There is an additional $7,500 catch-up provision if you’re over 50. You can change your contributions to the 457(b) per pay period. You may be eligible to rollover money from a former employer’s plan into your 457(b) plan immediately.

The Richards Group is an independent advisor to the 457(b) deferred compensation plan.

Carrier Contact Information

Lincoln Financial Group: 457(b) Retirement Plan

Customer Service: 800-234-3500

Website: www.lincolnfinancial.com

The Richards Group: Retirement Plan Consultants

Mike Mandracchia and Tracey John

Phone: 802-254-6016

Email: helpretire@therichardsgrp.com

Plan Forms and Documents

SmartConnect – Medicare Resource

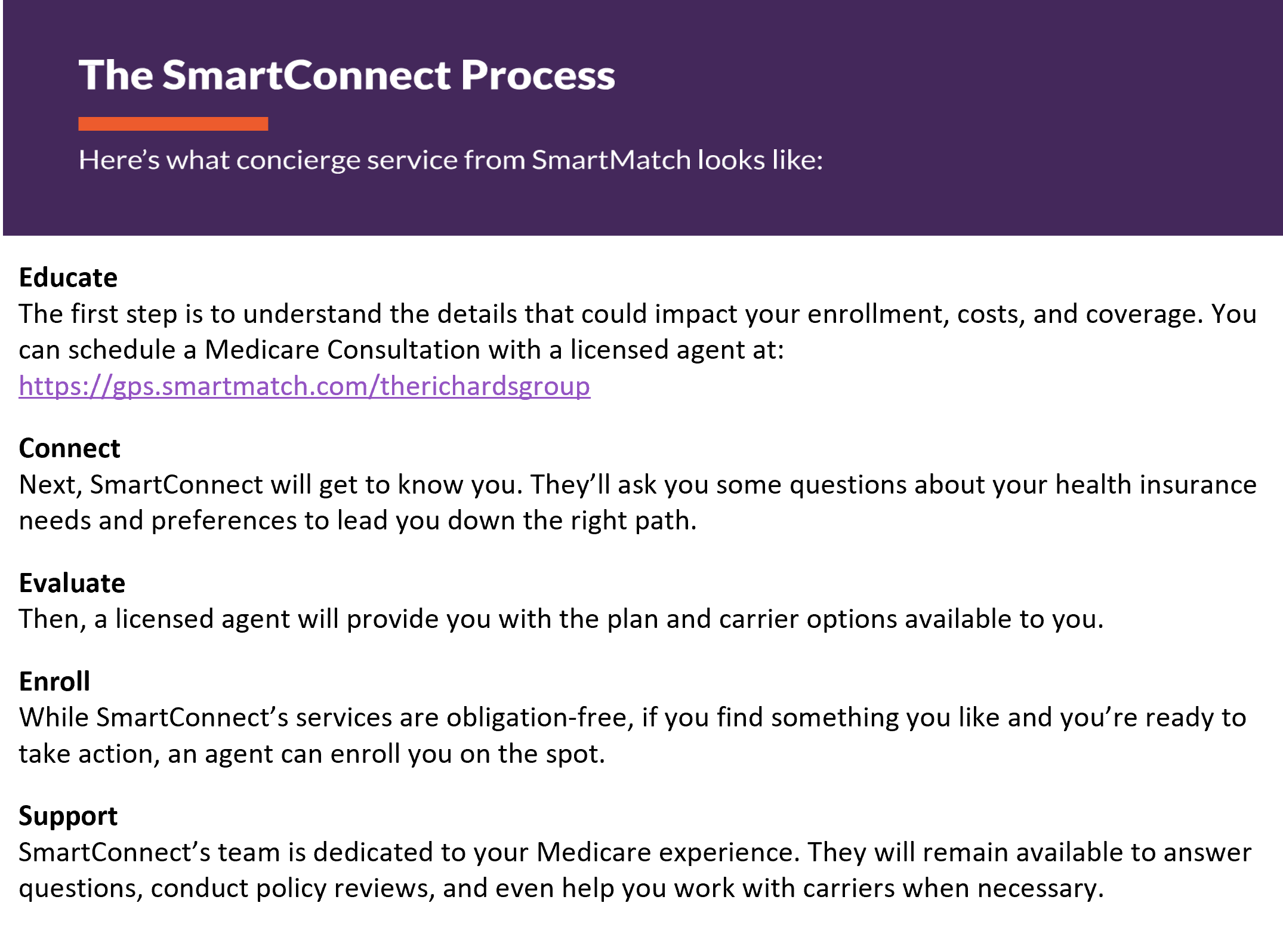

The Town of Brattleboro and The Richards Group have partnered with SmartConnect™, an exclusive, no-cost program created specifically to connect Medicare-eligible working adults to the world of Medicare benefits. Whether you plan to continue working or are transitioning to retirement, we tailor solutions designed around your needs. Our agents provide an unfiltered view of the entire range of options and prices available to you.

SmartConnect Contact Information

For more information or to get started, please click on the following link: https://gps.smartmatch.com/therichardsgroup

Additional Information

Recording of a SmartConnect Medicare Webinar

Employee Assistance Program

Eligibility

All employees are immediately eligible to participate in the Employee Assistance Program (EAP) offered by the Town of Brattleboro.

Program Details

An Employee Assistance Program is offered to all Town of Brattleboro employees and immediate family members through Invest EAP. This is a completely confidential counseling program that covers issues such as marital and family concerns, depression, substance abuse, grief and loss, financial assistance or other personal stressors.

EAP Contact Information

Invest EAP: Employee Assistance Program

Phone#: 800-287-2173

Website: www.investeap.org

Pet Insurance

Eligibility

Employees working 20 hours or more are eligible to participate in Pet Insurance offered by the Town of Brattleboro.

Program Details

Benefit eligible employees have the option of enrolling in Pet Insurance through Nationwide Pet at any time. Employees may purchase coverage on dogs, cats, and birds. All policies are individually underwritten and monthly rates are determined by breed, age, species, type of plan selected and state of residence. Premiums can be paid through payroll deductions (24 pay periods per year).

For more information or to enroll, please contact Nationwide Pet at 877-738-7874 or go to https://benefits.petinsurance.com/brattleboro

Pet Insurance Contact Information

Nationwide Pet: Pet Insurance

Phone#: 877-738-7874

Website: https://benefits.petinsurance.com/brattleboro

Additional Information

Vacation & Sick Leave

Vacation

- Union employees should consult their contract.

- Full time employees earn vacation at the end of the 1st month of employment. Unused time carries forward except accumulation shall not exceed 30 days on June 30.

- Except as noted below, annual vacation leave is based on continuous service to the Town and shall be computed as follows:

- Management employees accrue an additional one half (1/2) day per month. This vacation time is credited at the end of each month.

- Regular part time employees who work a regular schedule of 10 or more hours but less than 30 per week, who have 6 months of service receive prorated vacation and holiday benefits based on budgeted hours.

Sick Leave

- All full time Town employees shall earn sick leave at the rate of one day per month until one hundred twenty (120) days of sick leave have been earned. No additional sick leave shall be earned beyond one hundred twenty (120) days.

- An employee will begin to earn paid sick leave at the end of the first full month (30 days) of employment. Employees shall not be entitled to any compensation for sick leave before three (3) months of continuous full time employment or upon separation from the Town’s employment, nor will any sick leave be earned beyond the employee’s date of termination.